Proven Approaches for Effectively Managing Debt During Furlough

Proven Approaches for Effectively Managing Debt During Furlough

The COVID-19 pandemic has led to unprecedented challenges for the UK economy, resulting in numerous furloughs and layoffs across multiple sectors. As a consequence, many individuals are grappling with financial instability and the overwhelming burden of managing their existing debts while facing diminished income. If you have been furloughed for an extended period, tackling your debts may feel like a monumental task, particularly when your income is reduced to 80% of your usual salary. However, navigating this financial terrain is achievable by implementing effective strategies aimed at debt management and reduction. Here are essential steps you can take to regain control of your finances during these challenging times and work towards a brighter financial future.

1. Develop a Tailored Monthly Budget Reflecting Your Current Income

Start by crafting a revised monthly budget that encapsulates your current financial landscape. This budget must account for your reduced income while emphasizing your capacity to save effectively. Take the time to reassess your spending habits, and contemplate reallocating funds from non-essential expenses—such as entertainment, dining out, and luxury purchases—towards your critical bills and savings. By prioritizing your financial obligations and curbing discretionary spending, you can create a sustainable budget that not only helps you manage your debts more effectively but also prepares you for any potential future financial challenges that may arise.

2. Explore Additional Income Opportunities to Compensate for Salary Reduction

To meet your debt repayment commitments, it is crucial to explore ways to make up for the 20% salary reduction. Seek out alternative income streams, such as freelance gigs, part-time positions, or side hustles that align with your skills. Additionally, consider trimming your expenses by canceling rarely used subscription services or reassessing your grocery shopping strategies. Implementing a cost-effective meal planning strategy can lead to significant savings. Through proactive measures to increase your income and reduce expenses, you can stay on track with your debt obligations and avoid falling behind during your furlough period.

3. Consider Debt Consolidation Loans for Streamlined Payments

Look into the option of applying for debt consolidation loans for bad credit. These financial products are designed to simplify your financial commitments by merging multiple debts into a single, more manageable monthly payment. This strategy can alleviate confusion regarding due dates and payment amounts, making financial planning much easier. For individuals on furlough, a debt consolidation loan can provide a structured approach to managing a limited income while alleviating the stress associated with juggling various payments, ultimately aiding you in regaining your financial stability.

4. Strategize for Your Future Financial Goals and Security

As you navigate through your current financial situation, it’s vital to keep your long-term aspirations in mind, such as homeownership or launching your own business. Establishing these future objectives can serve as a powerful motivator to improve your financial condition. A debt consolidation loan can also contribute positively to enhancing your credit score, which in turn makes it easier to qualify for a mortgage or business loan with competitive interest rates. By strategically planning and working towards your financial aspirations, you can position yourself for future success and attain a greater sense of financial independence over time.

For further assistance and insights on managing your finances during the pandemic, and to learn how <a href="https://limitsofstrategy.com/understanding-good-debt-and-bad-debt-a-clear-guide/">debt consolidation loans</a> can support furloughed employees, reach out to Debt Consolidation Loans today for expert guidance.

If you are a homeowner or business owner, connect with the experts at Debt Consolidation Loans today to discover how a debt consolidation loan can enhance your financial health and stability.

If you believe a Debt Consolidation Loan aligns with your financial goals, don’t hesitate to reach out or call 0333 577 5626. Take the pivotal first step towards improving your financial situation with a single, manageable monthly repayment.

Discover Vital Financial Resources for Expert Advice and Support:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Is It Possible to Successfully Consolidate Your Medical Loan?

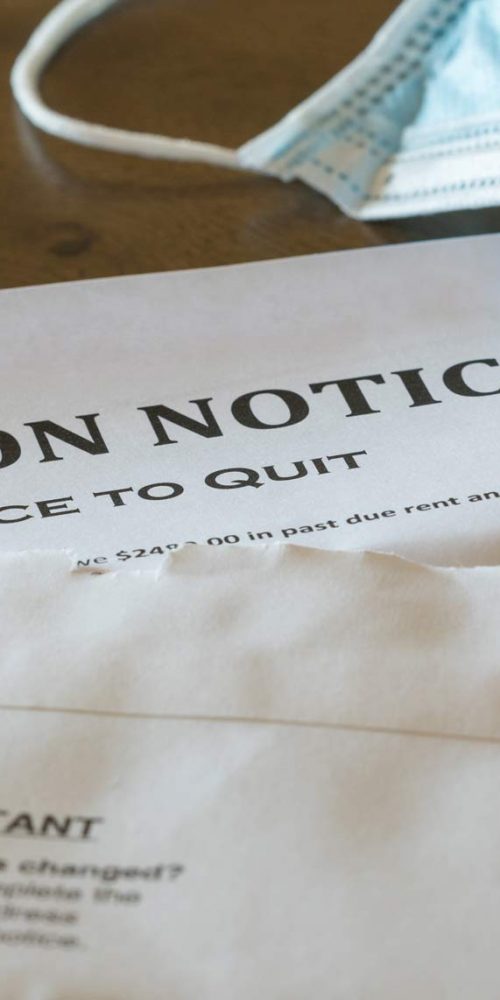

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Important Information on Evictions Postponed Until March

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Rapid and Effective Strategies for Quick Debt Relief

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Comprehensive Insights into the Benefits and Drawbacks of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning